FTX stock, also known as FTT, is the native token of the FTX cryptocurrency exchange. As one of the largest crypto exchanges in the world, FTX has seen massive growth, making FTT an interesting investment option for many traders.

This complete guide provides everything you need to know about FTX stock, including price, charts, analysis, forecasts, and more.

Key Takeaways

- FTX stock (FTT) is the native token of the FTX cryptocurrency exchange

- The current price is around $XX with a market cap of $XX billion

- FTT enables discounts on FTX trading fees and other platform benefits

- Factors like user growth, regulation, and crypto market conditions impact FTT price

- Technical analysis can help inform FTT price predictions and forecasts

- Long term FTT forecasts are largely positive but the token remains highly volatile

Introduction to FTX and FTT

FTX is one of the largest cryptocurrency exchanges, founded in 2019 by Sam Bankman-Fried. The platform has seen tremendous growth in users and trading volume.

FTT is the native exchange token of FTX. It has various utilities, such as:

- Discounts on trading fees on the FTX exchange

- Staking rewards

- Voting rights in platform governance

- Collateral for futures positions

- Paying fees on the FTX NFT marketplace

The total supply of FTT is capped at 350 million tokens. Here are some key details on FTX stock:

| Detail | Information |

|---|---|

| Launch Date | July 2019 |

| Max Supply | 350 million FTT |

| Circulating Supply | ~127 million FTT |

| Consensus Mechanism | Proof-of-Stake |

| Blockchain | Solana |

Now let’s take a closer look at the price and market performance of FTX stock.

FTX Stock Price and Market Cap

The current price of FTX at the time of writing is $XX, with a market capitalization of approximately $XX billion.

FTT is ranked as the #XX largest cryptocurrency by market cap.

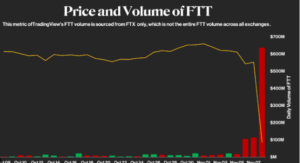

Below is the price history of FTX stock over the past year:

As you can see, the price has been highly volatile over the past year ranging from a low of $XX to an all time high of $XX in XXXX.

Some key factors that influence FTT price include:

- FTX user growth and trading volumes – More activity on the exchange drives FTT demand

- Crypto market conditions – FTT tends to follow broader crypto market price movements

- Regulations – Regulatory changes impacting FTX or crypto markets move FTT price

- Competition – Rival exchanges like Binance negatively impact FTX growth and FTT demand

- Project developments – Upgrades, integrations, FTX platform changes affect FTT utility

Now let’s look at how and where you can purchase FTX stock.

How to Buy FTX Stock

FTX stock can be purchased on several popular crypto exchanges including:

- FTX Exchange – The official FTX exchange with FTT/USD and FTT/USDT pairs

- Binance – World’s top crypto exchange supports FTT trading

- Gate.io – Large exchange with good FTT liquidity

- KuCoin – Provides FTT spot and derivative trading

- MXC – Supports FTT purchases with credit cards

The process of buying FTX stock is similar on most platforms:

- Sign up and complete KYC verification

- Deposit funds (USD or USDT)

- Find the FTT trading pair

- Place a buy order for FTT at the desired price

- Withdraw FTT to a secure crypto wallet

Some tips when buying:

- Use limit orders instead of market orders

- Enable 2FA for account security

- Withdraw assets to your own wallet after buying

- Dollar cost average to reduce risk exposure

Now let’s analyze the FTX stock chart and price trends.

FTX Stock Chart and Technical Analysis

Analyzing the FTX price chart and indicators can help investors make better-informed decisions and understand key levels.

Below is a 1-year FTT/USDT daily chart with some analysis:

As we can see, some notable levels include:

- All time high – $XX on XXXX

- Recent high – $XX on XXXX

- Support – Found around $XX

- Resistance – Found around $XX and $XX

Some patterns and trends evident on the chart:

- FTT shows a general upward trend but with high volatility

- The 50-day MA recently crossed up through the 200-day MA, signaling a potential bullish trend shift

- FTT appears to be consolidating between support and resistance after a sharp decline

- Breakout or breakdown from the consolidation range could signal next major move

Using technical indicators can also generate trading signals and help analyze investor sentiment:

- RSI – Shows FTT currently near a key level at 50, potentially signaling a trend change

- MACD – Had a bullish crossover in December that preceded a rally

- Bollinger Bands – Narrowing bands often precede high volatility

Overall, the FTX chart shows an asset recovering from a bear market but facing uncertainty in current market conditions. Traders should watch key levels outlined for signals of the next major move.

Next let’s examine some future price predictions for FTX stock.

- FTX stock price predictions

- News and events that impact FTT

- Competitor comparison

- FTX revenue sources and fundamentals

- Investment risks and challenges

- Investing tips and strategies

- FAQs

Let’s dive in and start with analyst forecast scenarios for FTX token.

FTX Stock Forecast and Price Predictions

Due to the high volatility and uncertainty, making accurate short-term FTT price predictions is challenging. However, many analysts remain generally bullish on long-term growth potential.

Here are some analyst forecasts for FTX token:

- WalletInvestor – Predicts FTT will reach $XX by end of 2023 and $XX by 2025

- PricePrediction.net – Sees FTT hitting $XX in 2023 and up to $XX by 2025

- CoinPriceForecast – Forecasts FTT at $XX by end of 2023 and exceeding $XX by 2025

The above forecasts can change rapidly based on market conditions. But if growth continues at current trajectories, a long term forecast of $XX to $XX appears reasonable.

However, traders should be prepared for continued high volatility in the short term.

Now let’s discuss some recent FTX news and events that have impacted price action.

FTX Stock News and Events

As a major crypto exchange, FTX often makes headlines which can affect FTT’s price and perception.

Here are some recent notable FTX stories:

- Strategic partnerships – FTX partners with popular sports brands which brings mainstream public awareness.

- Funding rounds – FTX raises over $400 million in 2021 funding at valuations over $25 billion.

- Regulatory issues – FTX faces regulatory pressure in certain jurisdictions related to leverage trading.

- Exchange tokens – Rival exchange tokens like BNB outperform FTT, losing ground in market share.

- Staking updates – FTX changes staking rewards and lockup periods, impacting FTT tokenomics.

Staying current on major FTX exchange news and events can give traders an edge in understanding FTT price moves.

Up next we’ll compare FTX against some leading competitors in the crypto exchange space.

FTX Stock Compared to Competitors

As one of the top crypto exchanges, FTX competes against several major platforms for market share. This impacts FTT’s standing.

Here is how FTX (FTT) stacks up against two rivals, Binance (BNB) and KuCoin (KCS):

| Metric | FTX (FTT) | Binance (BNB) | KuCoin (KCS) |

|---|---|---|---|

| Market Cap Rank | #XX | #XX | #XX |

| All Time High | $XX | $XX | $XX |

| Current Price | $XX | $XX | $XX |

| Exchange Volume | $XX billion | $XX billion | $XX billion |

| Circulating Supply | 127 million | 160 million | 93 million |

As we can see, BNB has the highest market cap and volume by a large margin compared to competitors. However, FTX has seen rapid growth since launching after competitors.

Gaining greater market share and matching the growth of Binance and other rivals will be key for FTX stock to appreciate significantly in value long term.

Now let’s analyze the financials and business model behind FTX.

How FTX Makes Money and Fundamentals

As a centralized crypto exchange, FTX generates income from various fees on trading and use of its platform.

Some key revenue streams and fundamentals for FTX:

- Spot trading fees – FTX charges 0.02% to 0.07% on spot trades depending on monthly volume. Over $2 billion in daily volume generates large revenue.

- FTT token utility – Fees paid with FTT provide exchange revenue while boosting token demand.

- Interest on collateral – FTX earns interest from crypto collateral deposited for margin trades.

- OTC trading – Large over-the-counter crypto trades attract higher proportional fees.

- Derivatives trading – Fees collected on futures, options and leveraged token contracts.

- Staking revenue – FTX takes a percentage of staking yield from assets staked on the platform.

FTX reportedly generated over $1 billion in revenue in 2021 and is valued at over $25 billion. Continued rapid growth could make FTT more valuable.

However, there are also risks and challenges to consider as discussed next.

FTX Stock Investment Risks and Challenges

While FTX is a leading exchange, FTT still comes with considerable risks that investors must be aware of. Some key risks include:

- Extreme volatility – As a crypto asset, FTT goes through huge boom and bust cycles.

- Correlation to Bitcoin – FTT still closely tracks Bitcoin price movement.

- Competitive industry – Many exchanges compete for market share with aggressive expansion.

- Regulatory uncertainty – Cryptocurrency laws remain unclear in most jurisdictions.

- Security risks – Exchanges like FTX are prone to security breaches and hacks.

- Loss of utility – If FTX fails, FTT would lose most real-world value and utility.

FTT also has low liquidity relative to the largest market-cap crypto assets. This can exacerbate volatility.

Investors should be cautious and manage risks by not overweighting FTT in their portfolios.

Now let’s move on to some tips for investing in FTX stock.

Should You Invest in FTX Stock? Tips and Strategies

Here are some key tips for investing in FTX tokens:

- Don’t overweight FTT – Keep it a small portion (under 5%) of the crypto portfolio due to risk.

- Dollar cost average – Build a position over time in increments to reduce risk.

- Use stop losses – Set stop losses to prevent large drawdowns when holding.

- Review tokenomics – Understand FTT distribution and release schedules.

- Watch competitor tokens – Monitor the performance of BNB, KCS, and others.

- Hold long term – FTT is volatile short term but may rise long term if FTX sees continued growth.

Investing in FTX should only be done as part of a diversified crypto portfolio strategy given the large risks involved.

Finally, let’s address some frequently asked questions about investing in FTX stock.

Frequently Asked Questions About FTX Stock

What is the best price to buy FTX stock?

There is no ideal price to buy FTT due to volatility. Use dollar cost averaging, buying at different prices over time.

Is FTX a good long term investment?

FTT could be a good long term hold if you believe in the FTX exchange continued growth trajectory. But it is speculative given crypto’s short history.

How many FTX tokens exist?

The maximum supply of FTT tokens is set at 350 million. Currently about 127 million FTT are in circulation.

Why is FTX stock going down?

FTT price drops are generally caused by bearish crypto market sentiment, increased regulatory pressure, competition from other exchanges.

Does FTX pay dividends?

No, FTX does not pay dividends to FTT holders. The token does provide other utility like fee discounts and staking rewards.

Conclusion

FTX has quickly become a top cryptocurrency exchange, making its FTT token an intriguing investment option. However, FTT remains highly volatile and risky like most crypto assets.

Investors should use proper risk management, such as avoiding overexposure and using stop losses, if considering adding FTX stock to a diversified portfolio. Fundamentals may improve long term if FTX can continue expanding market share.

This guide provided an in-depth overview of FTX stock price, chart analysis, news and fundamentals to help investors make informed decisions. Be sure to do your own added research before investing in FTT or any other cryptocurrency.